Tawney Kruger, a media expert at Financial IT and tech entrepreneur behind ventures including PraaktisGO, Zaytra.ai, and kpi.com, earlier shared about building and working in Uzbekistan. She has covered the realities of living as a foreign founder, setting up a business, and navigating visas and IT Park support. In this article, she continues that journey with a focus on what many founders and investors consider the most decisive factor in choosing Uzbekistan: its tax incentives.

Tawney Kruger, Tashkent, media professional and tech entrepreneur, linkedin

When I write about Uzbekistan’s tech ecosystem, I keep returning to one theme: opportunity. Unlike in many emerging markets, opportunity here is not just a buzzword, it is being codified into law, built into fiscal frameworks, and delivered through the state-backed IT Park. For startups and foreign investors, the most powerful lever remains the country’s generous package of tax incentives, which have turned IT Park residency into a competitive advantage.

If you’ve been following my series on building and working in Uzbekistan, you’ll know I’ve already covered the realities of living as a foreign founder, setting up a business, and navigating visas and IT Park support. This article continues that journey with a focus on what many founders and investors consider the most decisive factor in choosing Uzbekistan: its tax incentives.

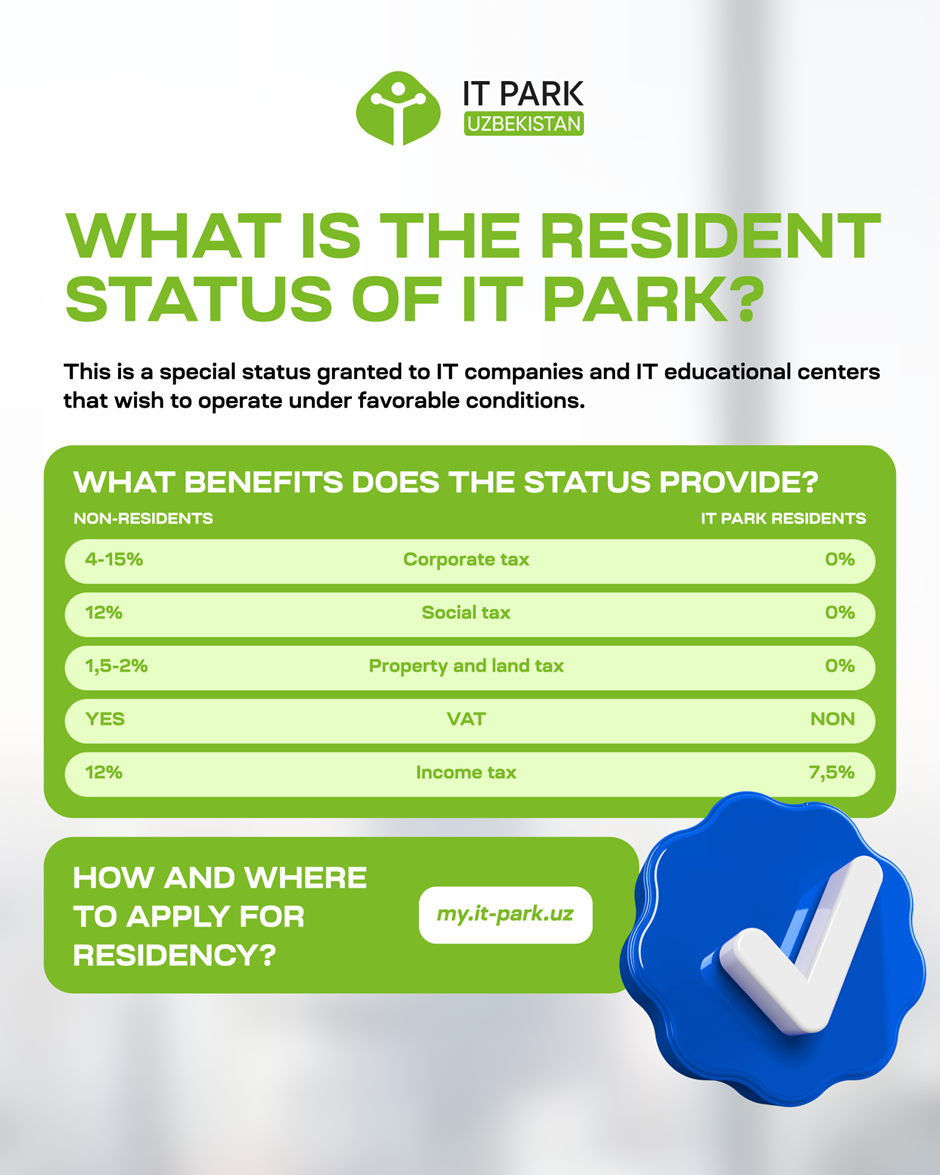

Since its creation in 2019, IT Park has offered one of the most preferable tax regimes in the region. Member companies enjoy full exemptions from corporate income tax, VAT, social tax, and turnover tax until January 1, 2028. Even employee income taxes are reduced, with a preferential 7.5% rate compared to the national 12%. For founders, these exemptions lower burn rates and extend runway at the most critical stages of development. For foreign investors, they provide predictability in a jurisdiction that is actively trying to align itself with global digital markets. On top of that, export-oriented companies, those generating more than 50% of their revenue abroad, can secure long-term relief through 2040. Dividends paid to foreign shareholders are capped at a 5% tax rate until January 1, 2040, and from 2028 onward, those firms will remain exempt from all taxes except VAT. In a region where tax structures are often unpredictable, Uzbekistan is sending a clear message: stay, build, and export.

The government has gone a step further in making the incentives attractive to international players. A new provision introduced in Presidential Decree No. 157, signed in October 2024, allows foreign IT service providers to qualify for corporate income tax exemptions from 2025 to 2030 if they deliver services to IT Park members whose export volume exceeds USD 10 million annually. This measure is specifically designed to attract international service providers that don’t benefit from double tax treaties, making Uzbekistan a more practical hub for outsourcing partnerships.

Beyond tax relief, the state is also tackling another significant barrier: infrastructure and equipment costs. Until January 1, 2040, IT Park members are exempt from customs duties on imported technology equipment, components. For startups that need servers, networking equipment, or specialized hardware, this means access to world-class infrastructure without the weight of duty payments. It also lowers entry barriers for foreign firms that might otherwise face capital-heavy import costs.

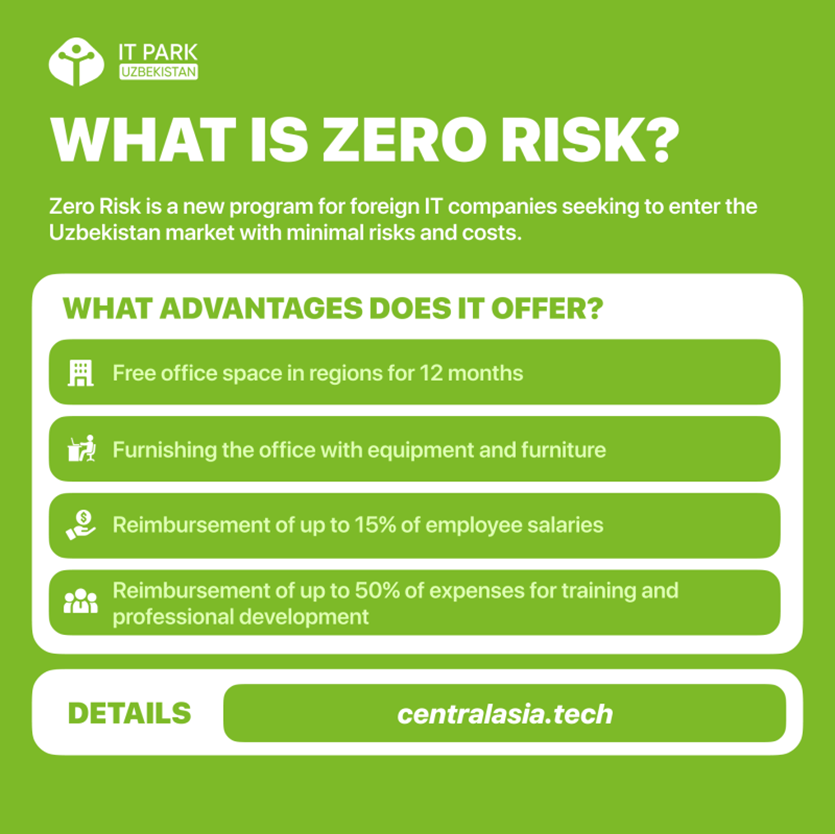

The tax framework is being paired with operational support, particularly through the Zero-Risk Program. This initiative gives new IT Park members free office space for up to 12 months in regional branches, helps furnish their workspaces with deferred payment options, and subsidizes payroll by covering between 5% and 15% of employee salaries depending on company size. It even reimburses up to 50% of staff training costs. For early-stage companies, these measures complement the tax breaks by reducing fixed overheads and creating a buffer against initial growth risks. Taken together, the fiscal and logistical support packages provide startups with what amounts to a de-risked launchpad (IT Park Programs Guide).

The impact of these policies is already visible in the numbers. By the end of 2025, IT Park Uzbekistan brought together more than 3,400 member companies, including over 970 companies with foreign capital. Uzbekistan’s IT services were exported to 90 countries worldwide, underscoring the sector’s growing global reach. North America remained the largest market, accounting for 45% of exports, followed by Asia-Pacific and CIS countries with 26%, Europe and the UK with 24%, and the MENA region with 5%.

These incentives are not just about short-term attraction; they form a layered fiscal strategy designed for sustainability. Immediate relief, such as tax holidays and customs exemptions, reduces early financial strain. Mid-term measures, like long-term dividend relief and partial post-2028 exemptions, ensure competitiveness for export-driven firms. Operational buffers, such as payroll subsidies and free office space, provide tangible support beyond tax policy. It’s this structured combination that makes Uzbekistan’s model distinct. Where other emerging markets may rely on one-off perks to attract investors, Uzbekistan is building a system that scales with the companies it hosts.

For entrepreneurs, the advantages are clear: lower operating costs, predictable taxation, and extended financial runway. For investors, the clarity of dividend taxation and long-term exemptions reduces uncertainty and enhances returns. While challenges remain — from infrastructure improvements to developing local talent at scale — the government’s fiscal strategy shows long-term vision. Tax incentives are not being offered as temporary lures but as cornerstones of an ecosystem designed to position Uzbekistan as Central Asia’s premier IT hub.

In the broader global context, Uzbekistan’s approach compares favorably with other startup-friendly jurisdictions. While places like Estonia and Georgia have gained reputations for streamlined regulation, Uzbekistan distinguishes itself through a rare combination: deep tax relief, customs exemptions, and operational support, all anchored within a state-backed institution.

Uzbekistan isn’t positioning itself for momentary spotlight; it’s laying the groundwork for long-term expansion and attracting the kinds of founders and investors who are ready to grow with a market that’s maturing at remarkable speed.

Enterprise Uzbekistan is designed to lower the cost and complexity of doing business for technology companies. Firms that join the center gain access to tax reductions, customs relief, and simplified administrative procedures through a centralized one-stop system with English-language tax support. Companies outside the membership framework may still operate within the ecosystem, but without these fiscal advantages. Combined with a clear legal structure, the model aims to give international businesses greater cost predictability and confidence when entering the Uzbek market.

Uzbekistan’s approach to building its tech economy is no longer experimental — it’s becoming structural. By pairing generous tax incentives with customs relief, operational support, and a maturing institutional framework, the country is creating conditions that many founders spend years searching for in other markets. The policies outlined above are not scattershot benefits or momentary boosts; they form an intentional system that lowers risk, rewards export ambition, and gives both startups and multinational players room to scale with confidence.

What stands out most is consistency. At a time when many emerging markets fluctuate between incentives and restrictions, Uzbekistan is moving in the opposite direction: toward clarity, predictability, and long-term alignment with global digital economies. Whether you’re a founder choosing your next base of operations or an investor evaluating frontier-market potential, the signal is increasingly hard to ignore. Uzbekistan is positioning itself not as an alternative, but as a serious contender — a place where technology companies can build, hire, export, and stay for the long haul.

And as new institutions like Enterprise Uzbekistan come, the ecosystem is shifting from promising to practical. It’s no longer just about incentives — it’s about creating a business environment where global companies feel they can operate with the same confidence they have in more established markets. That may be the strongest incentive of all.

27 February 2026

The US Branch of IT Park Uzbekistan becomes a member of the U.S. Chamber of Commerce

26 February 2026

Enterprise Uzbekistan enters operational phase

25 February 2026

Uzbekistan and Serbia expand cooperation in the IT Sector